Green, Jame, Markov, and Subasi (2012) – from Emory University, Atlanta, Georgia, the University of New South Wales, Australia, the University of Texas, Dallas, and the University of Missouri – studied the effects of broker-hosted investor conferences on the informativeness of analyst research.

They reviewed data on brokerage research reports and broker-hosted investor conferences and obtained data on stock recommendations from the Institutional Broker Estimate (I/B/E/S) Recommendation History dataset from 2004 through 2010. Their analysis included 2,749 investor conferences hosted by 107 brokerages.

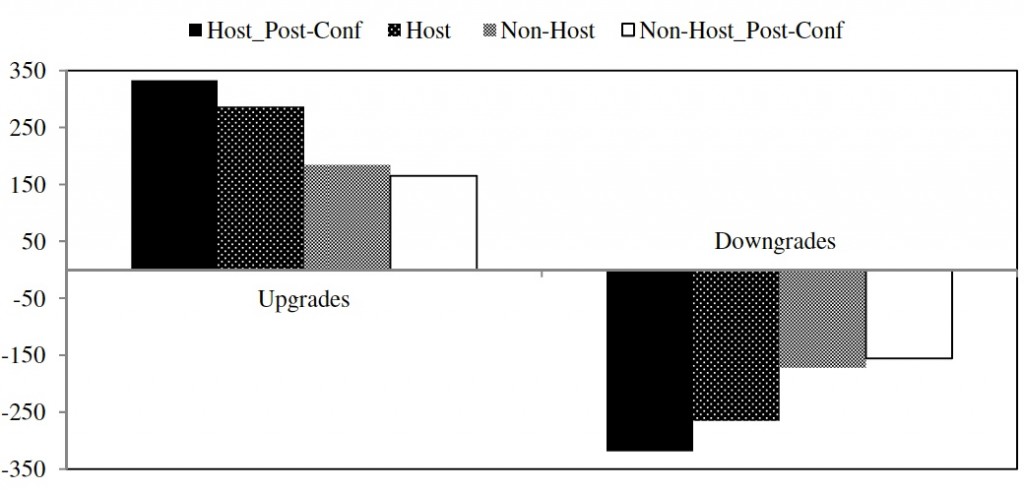

They found that analysts at brokerages with a hosting relation with a firm issued more informative recommendations changes than non-hosts. This difference was the largest during the post-conference period. They found that post-conference analyst upgrades from the hosting brokerage generated the largest two-day abnormal returns (3.33 percent). Post-conference downgrades from the hosting brokerage generated the most negative two-day abnormal returns (-3.19 percent). They also found that host upgrades generated larger, two-day returns than non-host upgrades (2.87 percent vs. 1.85 percent). They found similar patterns for downgrades. All of these findings supported the view that hosting brokers had closer relationships with the firms they invited to conferences and were thus able to issue more informative research.

The two-day, cumulative buy-and-hold abnormal returns for recommendation changes. The left column shows basis points (i.e., 1/100th of a percent). The sample spans 2004 – 2010 sample period. This includes 45,840 recommendation changes. Reprinted from Green, Jame, Markov, and Subasi (2012) with permission.

The incremental effect remained significant for three quarters. The post-conference effect was stronger for small, volatile stocks and when the analyst had more experience covering the firm. Analysts at brokers with a conference-hosting relation also issued more accurate earnings forecasts than non-hosts in the 90-day post-conference period. Their findings suggested that access to management has remained an important source of analysts’ informational advantage following the passage of Regulation Fair Disclosure.

Trading strategy: Keep track of brokerage-hosted investment conferences. Buy small, volatile stocks when they are upgraded by an analyst associated with the hosting brokerage. Short small, volatile stocks when they are similarly downgraded. Hold positions for two days.