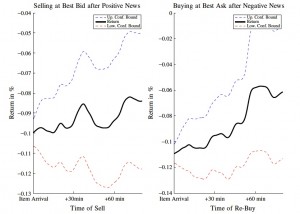

Groß-Klußmann and Hautsch (2011) confirmed the usefulness of the machine-indicated relevance of news items. Significant market responses to news were only observable for items which were identified as being relevant. Their results showed that the classification was crucial to filter out noise and to identify significant relations between market activity and the news flow.

The news sentiment indicator used by the researchers had predictability for future price trends. However, significantly increased bid–ask spreads around public news arrivals rendered simple, sentiment-based trading strategies rather unprofitable. The researchers noted that more sophisticated algorithms would be necessary to overcome this obstacle.

This chart shows that the abnormal returns were too low to overcompensate increased bid-ask spreads around news and to provide economic gains of the underlying trading strategies. Reprinted from Groß-Klußmann and Hautsch (2011) with permission from Elsevier.

to be continued ….