Wiesinger, Sornette, and Satinover (2013), of the Swiss Institute of Technology, Zurich, developed a method to “reverse engineer” real-world financial time series. They modeled financial markets as made of a large number of interacting rational Agent Based Models (ABMs). In effect, the ABMs are virtual investors. Like real investors and traders, they have limited knowledge of the detailed properties of the markets they participated in. They have access to a finite set of strategies to take only a small number of actions at each time-step and have restricted adaptation abilities.

Given the time series training data, genetic algorithms were used to determine what set of agents, with which parameters and strategies, optimized the similarity between the actual data and that generated by an ensemble of virtual stock markets peopled by software investors. By optimizing the similarity between the actual data and that generated by the reconstructed virtual stock market, the researchers obtained parameters and strategies that revealed some of the inner workings of the target stock market. They validate their approach by out-of-sample predictions of directional moves of the Nasdaq Composite Index.

The following five types of ABMs were employed:

- Minority Game. Here, an agent is rewarded for being in the minority. An agent has the possibility not to trade thus allowing for a fluctuating number of agents in the market.

- Majority Game. An agent is rewarded for being in the majority instead of in the minority.

- Delayed Majority Game. Like the majority game, but the return following the decision is delayed by one time step.

- Delayed Minority Game. This game is like the minority game, except for the delayed payoff.

- Mixed Game. Here 50% of the agents obey the rules of the majority game and the other 50% obeying the rules of the minority game.

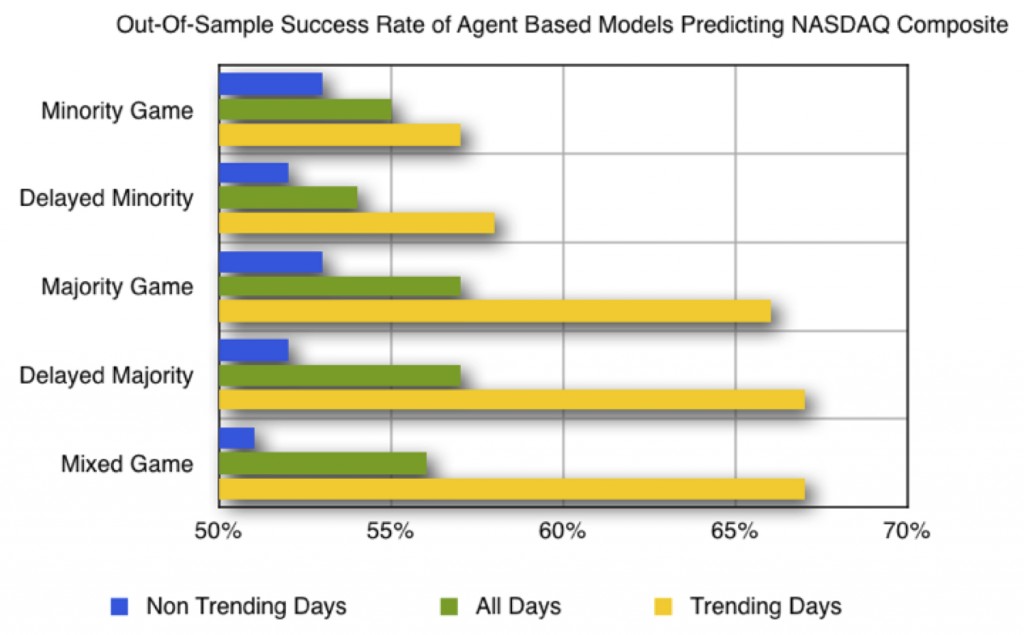

The models were trained on simulated market data using a genetic algorithm. They were then tested on out-of-sample, actual data from the Nasdaq Composite Index. The results, as shown in the following chart:

All agent based models performed to a level of statistical significance. This was largely due to the success of the models in trending markets. Interestingly, both the trend-following and contrarian strategies worked well during the trending markets. Similar results are reported by active traders.

Note: This blog was excerpted from my article to be published in the Fall 2013 issue of FORESIGHT: THE INTERNATIONAL JOURNAL OF APPLIED FORECASTING. To see the entire article, click here: Future of Financial Forecasting