The following example of a breakthrough in pattern-recognition technology is reprinted from my book The Alpha Interface: Empirical Research on the Financial Markets, Book Two. It exemplifies the level of creativity and power available to the new generation of personal computers with parallel processing capacity.

Fong, Tai and Pichappan (2012) from the University of Macau, China, and the University of Riyadh, Saudi Arabia presented a new type of trend-following algorithm – more precisely, a “trend recalling” algorithm – that operated in a totally automated manner. It worked by partially matching the current trend with a proven successful pattern from the past. The algorithm drew upon a database of 2.5 years of historical market data.

The system spent the first hour of the trading day evaluating the market and comparing the initial market pattern with hundreds of patterns from the database. The rest of the day was spent trading based on the match that was eventually made, with regular updates to change patterns if necessary, and using sophisticated trading algorithms to avoid conditions where volatility was either too high or too low. Their experiments, based on real-time Hang Seng index futures data for 2010, showed that this algorithm had an edge in profitability over the other trend-following methods.

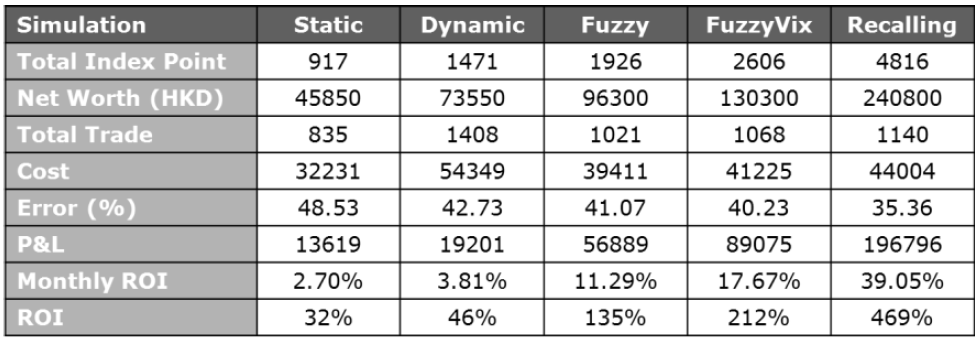

The new algorithm was also compared to time-series forecasting types of stock trading. In simulated trading during 2010, after transaction costs, the system attained an annual return on investment of over 400%, making over 1,100 trades. The following figure compares the trend-recalling protocol to four other trend-following algorithms (as listed on the top of the chart):

This mind-boggling result of a return greater than 400% is the most robust I have encountered thus far in my survey of the scientific literature on the financial markets. It requires the creation of a unique database for each market being traded. In all likelihood, not every market will provide results as strong as these found in the Hang Seng index. However, there are many potential markets that could be exploited in this manner. Considering the costs of developing trend-recalling algorithms and also creating unique databases for each market, the potential for success seems considerable for those who are equipped and ready to pursue this path.

One commercially available approach for possibly implementing a trend recall strategy is the Pattern Matcher Add-on to the NeuroShell Daytrader Professional software package.