This is the Introduction to Book One of The Alpha Interface series.

Each day in the United States and elsewhere, thousands of security analysts go to work at hundreds of different brokerage firms. They provide market analysis, write research reports and issue forecasts. According to the advisory firm Tabb Group (Johnson 2006), asset managers in the U.S. and U.K. spent $ 7.7 billion on internal and $ 7.1 billion on external research in 2006. This may seem like a great amount of money to spend on research, but consider that these firms are responsible for many trillions of dollars of assets under management. According to Maguire, et al. (2007), the asset management industry is responsible for a large amount of capital invested on behalf of its clients: globally, $53.4 trillion, almost 110% of world GDP, were under management in 2006, $24.3 trillion invested in equities. As the chart below shows, analyst activity has been on an uptrend.

This chart shows the increasing number of analyst target price changes for US firms, obtained from the I/B/E/S database, from 2001-2007. This trend is also reflected in the increasing number of analysts and the increasing number of companies being covered by analysts. Chart based on data reported in Klobucnik, Kreutzmann, Sievers, and Kanne (2012).

While sell-side analysts (i.e., those who work for brokerage firms and underwriters) have been researched with scrutiny by investors, regulators and academics, buy-side analysts (i.e., those who work internally, and thus privately, for various investment funds) have received far less attention.

Sell-side analysts through their forecasts attempt to predict and influence relative stock price movements in individual stocks and industries. They are also important contributors to the underwriting arm of their investment banks. They help investment bankers secure new business through their knowledge of the target firm’s industry and their reputation as key opinion leaders and valuation experts for the industry.

While, their efforts enhance the informational efficiency of financial markets, ironically this simultaneously diminishes the marginal value of their work. In a perfectly efficient market, analysts would not be able to add any value because market prices already would reflect any information analysts might have.

Information about analysts’ stock Forecasts generally is given first to important clients of a brokerage firm and only then released to the general public. During the period between the prerelease of information and the public announcement, these clients possess private information and, thus, can be viewed as informed traders. There are typically several hours during that informed clients can act on the analyst recommendation before the news is publicly released. Insofar as private information contained in analyst Forecasts had value, informed traders were able to earn a return on this information until the price of common shares fully incorporated the new information.

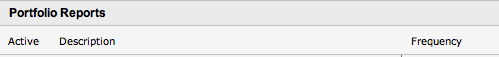

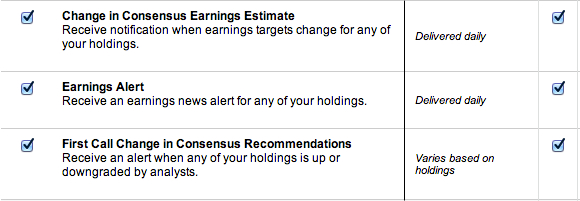

If you are new to trading and investing based on analyst recommendations, probably the best data resource for you will be your own online broker. Many online brokers now offer, at no extra cost, regular alerts when analyst recommendations or earnings estimates are revised. The following graphic shows the reports available through one online broker:

After the internet bubble burst in 2000, investors grew increasingly suspicious of the value of U.S. sell-side, stock analyst Forecasts. With the investment banking business booming in the late 1990s and early 2000, there were media reports that these analysts were focused on attracting and retaining clients rather than on writing research reports that accurately reflected their opinions of the companies they were following. Furthermore, it became well known that analysts were behaving in an over-optimistic manner and traders needed to develop strategies to compensate for this.

On August 15, 2000, the SEC adopted Regulation Fair Disclosure (Reg FD) to address the selective disclosure of information by publicly traded companies and other issuers. Regulation FD provides that when an issuer discloses material nonpublic information to certain individuals or entities – generally, securities market professionals, such as stock analysts, or holders of the issuer’s securities who may well trade on the basis of the information – the issuer must make public disclosure of that information. In this way, the new rule aims to promote full and fair disclosure. The aim of this regulation has been to eliminate any unfair advantage offered by companies to some investors and analysts but not to others. Research, below, shows that Reg FD has been largely, but not entirely, successful in changing the investment environment.

There are many questions that researchers have explored regarding the process by that analysts evaluate the market, make forecasts and recommendations. And, of course, there are many more questions concerning how the market then reacts to the analysts’ output. In selecting research to report in this book, I have been guided by one principle: Is there a viable trading strategy that can be found here?

———————————————————————–

Klobucnik, J., Kreutzmann, D., Sievers, S., & Kanne, S. (2012). To buy or not to buy? The value of contradictory analyst signals.

Maguire, A., Morel, P., Kurstjens, H., Spellacy, M., Donnadieu, H., & Ortelli, M. (2007). The growth dilemma. global asset management 2007. The Boston Consulting Group.