Fang and Yasuda (2012), from INSEAD (the European Institute for Business Administration) and the University of California, Davis, examined the predictive abilities of the All-American (AA) analysts selected by Institutional Investor magazine. They used recommendation data from the I/B/E/S Detailed History file from October 1993 to December 2009.

The annual election of AA analysts has been the most visible and influential way in which analysts have been evaluated. Each spring, Institutional Investor sends out hundreds of surveys to buy-side fund managers to vote for the best analysts by industry, and the results are announced in the October issues of the magazine. The outcome of this evaluation has been one of the most important drivers of analyst pay. Information on the most recent results can be found here.

They found that AA made buy and sell recommendations with up to seven percent higher annualized risk-adjusted returns than other analysts. This performance differential existed both before and after AAs were elected, was not explained by announcement effect, and was not significantly eroded by Reg FD. This suggested that the AA analysts were, indeed, more skillful as opposed to having either a greater reputation or greater access to privileged information.

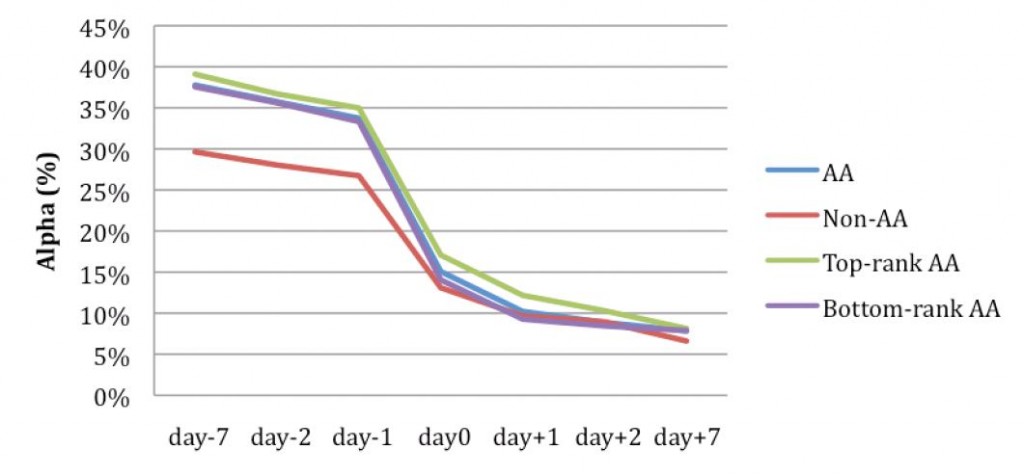

Risk-adjusted portfolio returns earned by hypothetically trading on AA and non-AA recommendations at various timings. The chart above shows buy recommendations. All alphas (i.e., returns beyond those of the market averages) are expressed as annualized returns in percentage points. Reprinted from Fang and Yasuda (2012) with permission.

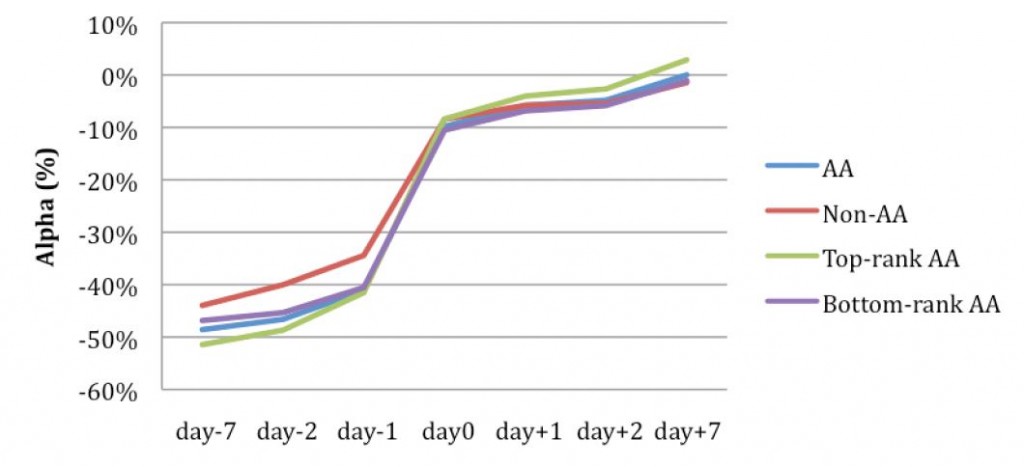

Risk-adjusted portfolio returns earned by hypothetically trading on AA and non-AA recommendations at various timings. The chart above shows sell recommendations. All alphas (i.e., returns beyond those of the market averages) are expressed as annualized returns in percentage points. Reprinted from Fang and Yasuda (2012) with permission.

Profits from AAs’ recommendations diminished quickly with access delay. The study concluded that institutional investors were effective in evaluating analysts and that the AA status at least partially reflected real skill. While institutional investors have been well positioned to benefit from AAs’ views, other investors have had limited ability to do so. For investors without early access, the gain over other analysts was four percent per year and was confined to buy recommendations made by top-ranked AAs (analysts winning the first- and second-place titles for each industry). Thus, mass investors’ ability to “piggyback” on the AA title information about analysts was limited.

Trading strategy: Track the recommendations made by #1 and #2 ranked All-American analysts. Enter a trade, long or short, before the close of the day on which buy or sell recommendations are publicly announced. Hold the position for seven days. This strategy can be enhanced by also paying attention to the strength of the recommendation.