Many respondents to my previous post on the rise of supercomputers in the world of finance focused on high frequency trading (HFT). However, I believe that the use of supercomputers for financial research is at least as important. Here is one example of how supercomputer research has uncovered a social factor that correlates strongly with reckless CEO behavior.

BoardEx is a business intelligence service used as a source for academic research concerning corporate governance and boardroom processes. It holds in-depth profiles of over 400,000 of the world’s business leaders, and its proprietary software shows the relationships between and among these individuals. This information is updated on a daily basis.

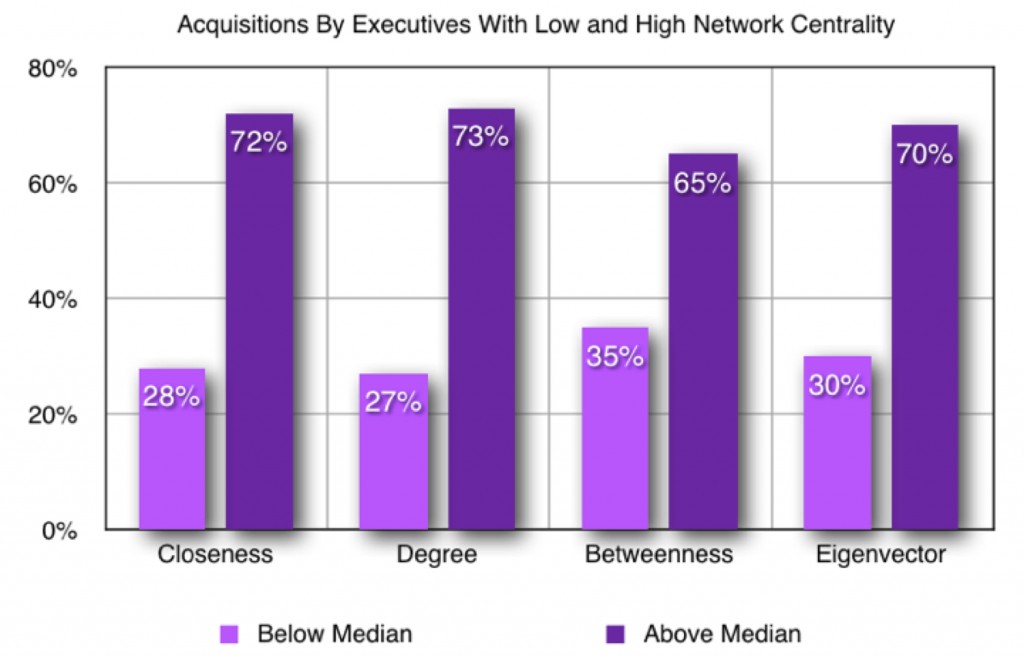

El-Khatib and colleagues (2012) from the University of Arkansas used a supercomputer to analyze this data. They calculated four measures of network centrality – Degree centrality, Closeness centrality, Betweenness centrality, and Eigenvector centrality – for each executive connected into such business networks. Degree centrality was the sum of direct ties an individual had in each year. Closeness centrality was the inverse of the sum of the shortest distance between an individual and all other individuals in a network. Betweenness centrality measured how often an individual rested on the shortest path between any other members of the network. Eigenvector centrality was a measure of the importance of an individual in the network, taking into account the importance of all the individuals that were connected in the network.

The amount of computation was daunting and required storing information for each and every possible pair of business leaders in computer memory. Processing the Closeness factor, for example, took about seven days on the “Star of Arkansas” supercomputer at the Arkansas High-Performance Computing Center. The final result, interestingly, showed that CEOs more centrally positioned were more likely to bid for other publicly traded firms, and these deals carried greater value losses to the acquirer as well as greater losses to the combined entity. The researchers followed the CEOs and their firms for five years after their first value-destroying deals, and found that firms run by centrally positioned CEOs better withstood the external threat from market discipline. Moreover, the managerial labor market was less effective in disciplining centrally positioned CEOs because they were more likely to find alternative, high paying jobs. Ultimately, they showed that CEO personal networks could have their “darker side” – well-connected CEOs became powerful enough to pursue any acquisitions, regardless of the impact on shareholder wealth or value.

As shown in chart above, across all four dimensions of CEO network centrality, the research study clearly demonstrated that CEOs with the most social connectivity were those most willing to make risky, and generally unprofitable, acquisitions.

This blog entry was excerpted from my recent article in Foresight: The International Journal of Applied Forecasting. Here is a link to the entire article: Future of Financial Forecasting.