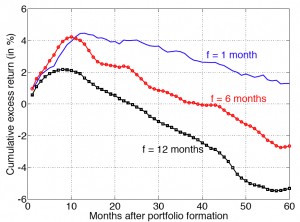

Menkhoff, Sarno, Schmeling, and Schrimpf (2012) – of Leibnitz University, Hanover, Germany, Singapore Management University, and the Bank for International Settlements in Basel, Switzerland – examined forex data from January 1976 to January 2010 in 48 different countries. They found that momentum strategies (i.e., buying past winners and selling past losers) yielded substantial (and statistically highly significant) excess annualized returns of about 6 – 10% for short holding periods of one month. Their profits slowly faded out when increasing the holding period.

This figure shows cumulative average excess returns to three different long-short currency momentum portfolios after portfolio formation. Momentum portfolios differed in their formation period (f = 1; 6; 12 months). The researchers built new portfolios each month but tracked these portfolios for the first 60 months after their formation so that they were effectively using overlapping horizons. Excess returns were monthly. The sample period was 1976 – 2010. Reprinted from Menkhoff, et al., (2012) with permission from Elsevier.

The researchers found, however, that momentum portfolios in the FX market were significantly skewed towards minor currencies that had relatively high transaction costs, accounting for roughly 50% of momentum returns. Also, the concentration of minor currencies in momentum portfolios raised the need to set up trading positions in currencies with higher idiosyncratic volatility, higher country risk, and higher expected risk of exchange rate instabilities, which clearly impose risks to investors. Hence, there seem to be effective limits to arbitrage that prevent a straightforward exploitation of momentum returns.

Trading strategy: Focus on minor currencies. Use a six-month formation period with a one-month holding period. Take both long and short positions. Rebalance monthly.